Progressing CO2 transport and storage

The geological formations of the North Sea Basin are recognised as a premier resource for the permanent storage of CO2 from power and industrial emissions sources in countries bordering the basin as well as across northern Europe. Safe and efficient storage has been demonstrated for more than a decade at Sleipner in the Norwegian sector.

A number of high level techno-economic studies have investigated what pipeline and shipping infrastructure solutions might look like to handle different flows of CO2 from the major emitting industries of the UK and northern Europe by 2050. These studies provide guidance on what future networks could/should be constructed, but do not address the practical details of planning, consenting, designing and deploying the first pipeline segments or shipping facilities. In order to achieve a least cost pathway towards Europe’s aspirational decarbonisation targets, this detailed work needs to commence during the next five years and be co-ordinated with offshore storage appraisal and development. The framework in which this could be progressed is governed by the European Strategic Energy Technology (SET) Plan Integrated Roadmap, with potential funding coming from the Connecting Europe Facility (CEF) and Horizon 2020.

Kick-starting North Sea CO2 infrastructure

Under the CEF CO2 thematic group it should be possible to investigate the feasibility and requirements for the first pipeline(s) which will provide the foundation for a northern European CO2 transport network. Realistically there are only a handful of opportunities in the near term that, with a little clever planning, would be able to leverage the money and hard work already undertaken to bring forward the first full chain carbon capture and storage (CCS) projects. Pipelines of course need sources and sinks at either end; so critical to any early work by the CO2 thematic group is linking a pipeline proposition to potential storage sites. In northern Europe these will need to be offshore in the North Sea Basin.

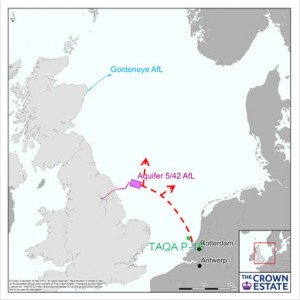

Large emissions clusters exist in both the Antwerp/Rotterdam and UK Humber Valley areas. The ROAD project in Rotterdam along with the Don Valley project in the Humber have been the recipients of European Commission funding support through EEPR, and the White Rose project in the Humber has been awarded NER300 funding support. These are all associated with geological storage opportunities in each of the Dutch and UK sectors of the North Sea. The TAQA P-18 depleted gas reservoir site and the National Grid (NG) 5/42 saline aquifer site are the subjects of existing projects’ FID (final investment decision) and FEED (front end engineering design) activities, respectively. CO2 from Antwerp sources could in principle be piped to the Rotterdam area for onward transportation to the North Sea Basin.

The adjacent map shows these storage sites and a possible North Sea bidirectional pipeline between the Netherlands and the UK southern North Sea. The arrows show the potential for expanding this over time to a network of pipelines with destinations further north or east.

There is a compelling case for undertaking a project definition study and facilitating the construction of this pipeline before waiting for future demand to materialise. ZEP and the UK Transport and Storage Development Group have advised that co-operation and regional management plans will be essential to enable the optimal and commercially efficient deployment of transport and storage networks. It is not reasonable to expect the private sector to build large, long distance pipelines in the North Sea Basin ahead of demand. Shorter, sensibly planned and financeable pipeline segments can provide the ‘stepping stones’ to the future, creating a virtuous cycle related to the timing of storage appraisal and construction of capture facilities.

The Humber Valley pipeline associated with the White Rose project in the UK will have a capacity of approximately 17Mtpa, exceeding the capacity of the already large aquifer storage site being advanced by NG over the normal lifetime of power plants. Critically, storage appraisal is required to match future demand, enable new onshore projects and capture facilities after White Rose to be financeable, and progress towards taking FIDs.

Co-ordination and optionality over injectivity and storage capacity will contribute to lowering technical and performance risk, providing operational redundancy, and helping financing institutions and developers to achieve workable commercial structures. Due to the long lead times for large aquifer appraisal and the need for staged development, a pipeline providing access to smaller, relatively lower risk, depleted fields in the Netherlands will be a practical way to reduce risk and uncertainty for Humber Valley sources.

Likewise, in order for capture projects to progress in the Rotterdam and Antwerp areas beyond the ROAD project, there will be a requirement to have options for storing CO2 in an appropriate time frame ahead of them reaching FIDs. If the proposed pipeline were constructed early enough, aquifer storage in the UK southern North Sea would be accessible ahead of further development of Dutch storage sites. This phasing benefit could provide options for industrial pilot projects that otherwise would not be able to progress beyond the FEED stage. Furthermore, the additional system-level benefits created for Europe would include faster emissions abatement and development of the sector, de-risking, and cost reductions through economies of scale.

Are CEF and Horizon 2020 enough?

A project definition study as described above would cover all technical, legal, regulatory, consenting, commercial (including third party access) and operational details for such a pipeline and look at options for offshore facilities, such as booster station/platform, valves, junctions, subsea manifolds etc., that would enable future network expansion and flexibility. But this will need to be publicly funded as no incentive exists for the private sector to undertake such work, and who could realistically invest?

A key question remains over whether the current CEF and Horizon 2020 mechanisms can help, given the need for a collaboration of competent organisations and experts from the UK, Netherlands and Belgium who are currently working on/with existing project developers. This work is neither FEED for project development nor research as such. Perhaps some new thinking is required on how to support, fund and progress such important early stage infrastructure activities.

Dr Ward Goldthorpe

Portfolio Manager CCS and Gas Storage

The Crown Estate

tel: +44 (0)207 8515311

[email protected]

www.thecrownestate.co.uk